It’s always been quite easy to get to eBucks level 5. The problem is that there are new rules which come out on 1 July every year. Normally the changes are small, so you just need to update yourself on the new rules once a year and you should continue enjoying eBucks level 5 rewards.

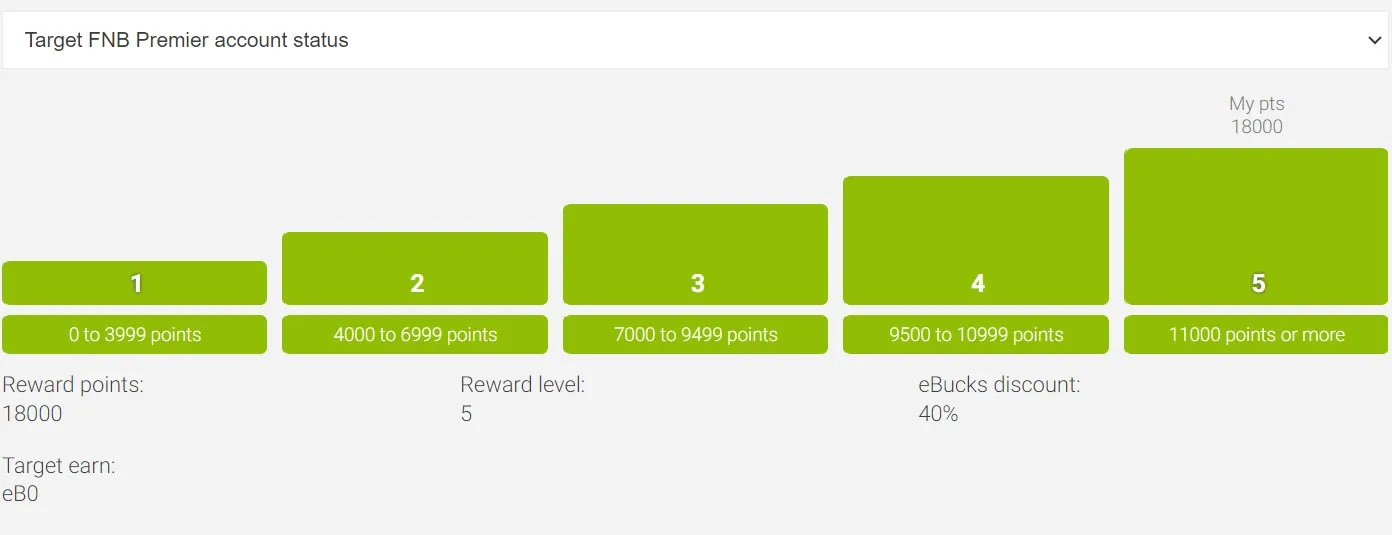

You need 11 000 points to get to Reward Level 5 if you have an FNB Premier Account under the new eBucks rules which became effective on 1 July 2024. You can check the full set of rules on the eBucks Calculator website. In the table below I’ve hand picked the easiest actions to get you to 12 000 points which is slightly more than required.

| ACTION REQUIRED | POINTS |

| Income Deposits | |

| Have a minimum monthly deposit of R16,500 | 2 000 |

| Digital Banking | |

| Do at least 6 financial transactions per month via the FNB App. | 500 |

| View the ‘Track my rewards’ tab on the FNB App every month. | 1 000 |

| Engage with 2 or more of the following on the FNB App under “Nav-igate Life” > nav>> Money: My Net Worth OR Credit Status OR Have at least 3 budget categories setup in Smart budget and access your Smart Budget every month | 1 000 |

| Maintain a healthy credit status with nav» Money with a status in Light Green or Dark Green. | 500 |

| Cards | |

| Have an active FNB Fusion account with a credit limit and an active card OR Have an FNB Credit Card account with a credit limit and an active card | 1 000 |

| Use your Virtual Card for 80% of your qualifying online spend in a calendar month. | 2 000 |

| Use your Virtual Card for 80% of your qualifying in-store spend in a calendar month. | 1 000 |

| Save and Invest | |

| Grow your FNB Savings OR Investment Account(s) by at least R1,400 per month. (Interest, profit and other returns are excluded.) | 500 |

| Home | |

| Have an FNB Home Loan, FNB Smart Bond, or FNB Islamic Home Loan OR Have a Pension Backed Loan AND have a salary stop order in place. | 1 000 |

| Manage your property or use one of the available services under the nav» Home tab on the FNB App once a quarter. | 500 |

| Family | |

| Add your spouse under the ‘My family’ tab on the FNB App or speak to your banker. Your spouse must verify the relationship via the app and must have an aligned, active FNB Premier account. | 1 000 |

| TOTAL | 12 000 |

I understand that there might be some actions above which aren’t easy for you to perform. For example you might not own a property. Luckily there are many other ways to earn eBucks if you have a Premier Account. You can obviously view all the options on the eBucks Calculator, but below are some examples which you might find useful:

- Digital Banking:

- Pay your bills using FNB Pay Bills on the FNB App every month (500 points if you spend between R250 and R500 and 1 000 points if you spend more than R500)

- Make at least 3 Real Time Payments every month (1 000 points)

- Cards:

- Have an active FNB Fusion account with a credit limit and an active card

AND

Have an FNB Credit Card account with a credit limit and an active card

(If you have both of these rather than just one of them, you’ll earn a further 500 points)

- Have an active FNB Fusion account with a credit limit and an active card

- Save and Invest:

- Maintain a minimum monthly balance of at least R16,500 across your FNB Savings Account(s) that are accessible within 7 days, without incurring early withdrawal fees:

- R16 500 – R32 999 (500 points)

OR - R33 000 – R49 499 (1 000 points)

OR - R49 500 (1 500 points)

- R16 500 – R32 999 (500 points)

- Maintain a minimum monthly balance of at least R16,500 across your FNB Savings Account(s) that are accessible within 7 days, without incurring early withdrawal fees:

- Other (I’m not going to go into detail here, but it’s also possible to earn points through the following):

- Savings Account(s) with a term of longer than 8 days

- Tax-Free: Shares, Unit Trusts or Cash Deposit Accounts

- Investment Accounts via the FNB Investor Platform

- Offshore Banking

- Insurance

- Adding your child under the ‘My Family’ tab on the FNB App and having an active linked FNBy transactional account for your child,

OR

have a linked FNBy savings account (Savings accounts for children under 18) with a balance that grows by R200 per month.

1 thought on “How to Get to eBucks Level 5 on a Premier Account: New Rules”