I’ve been a fan of the eBucks rewards programme for several years now and consider myself to be an expert at milking it for all it’s worth. Understanding how it works is essential if you want to maximise the benefits offered through First National Bank’s scheme. I you ever want to get anywhere with eBucks, you need to know how to use the eBucks Calculator as it helps you to gauge the potential rewards you can accumulate by using FNB personal banking or private banking services. It helps you to figure out your potential reward level, the amount of eBucks you can earn and how those rewards can translate into Rands.

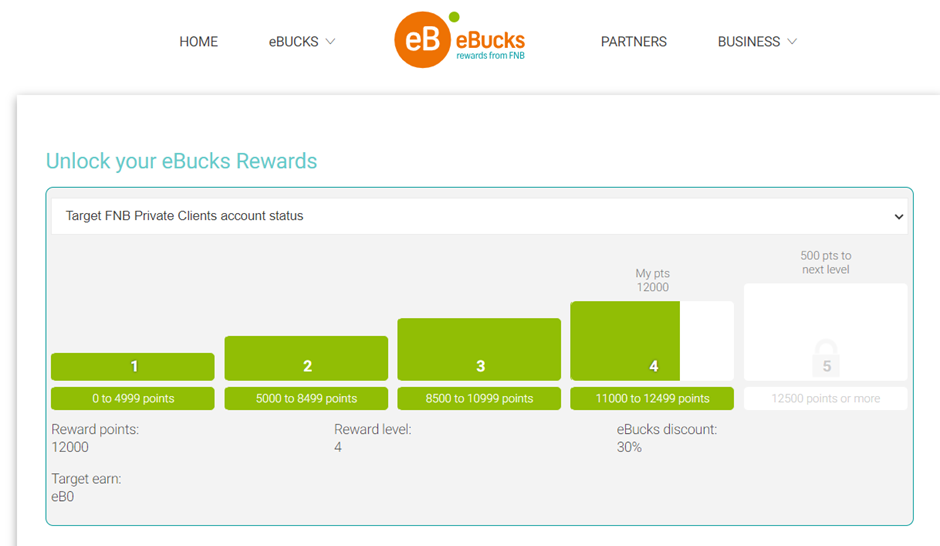

Using the eBucks Calculator is easy. By capturing key details about your banking behaviour and product choice, you can easily see how many rewards points you’re able to earn based on your everyday spending and banking practices. These points determine your reward level which dictates the number of eBucks you can earn. Based on my experience of eBucks and other rewards programmes in South Africa, FNB makes it the easiest for customers to be rewarded and the calculator plays a major role in ensuring this. I recently did a comparison between eBucks and Vitality which you might find interesting.

How the eBucks Calculator Works: A Step-by-Step Guide

Here’s how the eBucks Calculator works:

1) Access the Calculator: Here’s the link.

2) Input Bank Account Type: Enter the details of your FNB bank account as the rules are different depending on your account type:

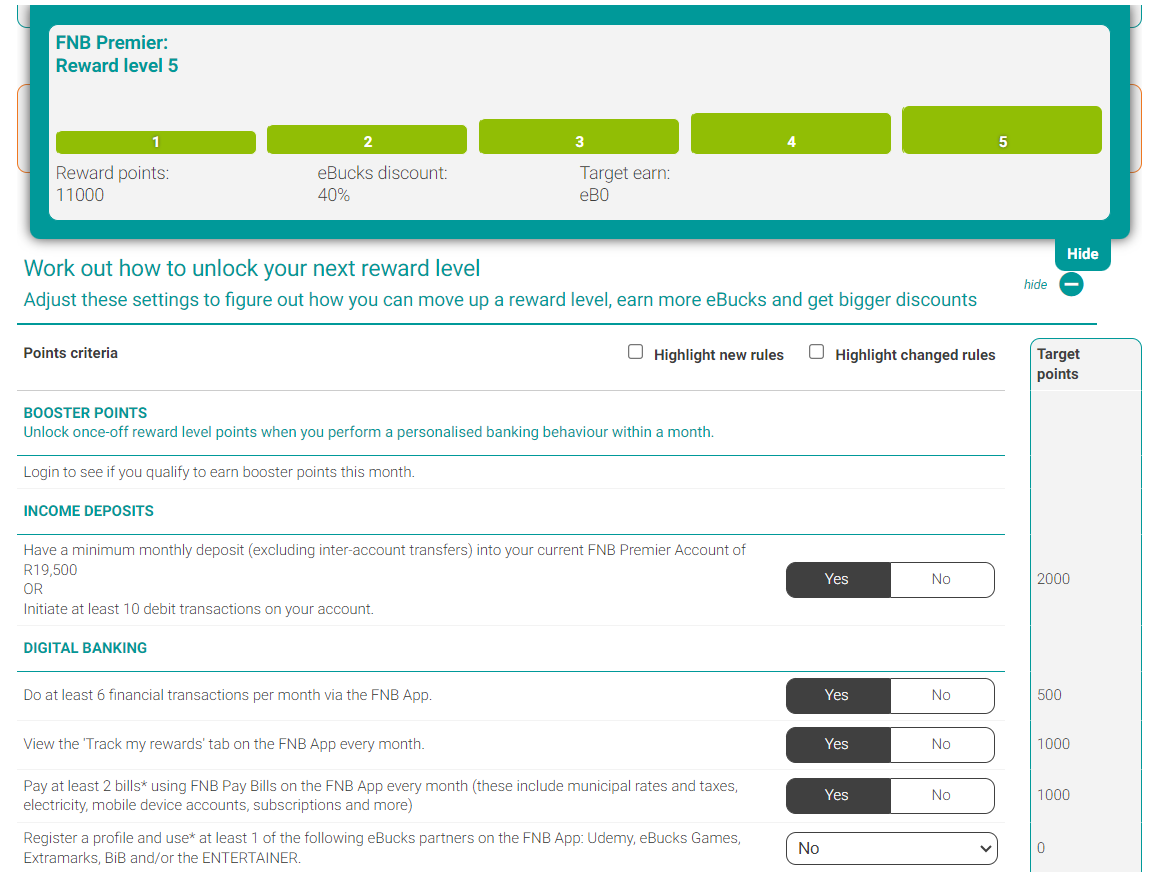

3) Specify Banking Habits: Capture the information in the section entitled “Work out how to unlock your next reward level”. Based on the information that you capture, the calculator will work out how many points you will earn each month. The points determine which reward level you will achieve. The reward level determines the rate at which you will earn eBucks.

You’ll see that it’s actually super easy to get to level 5. Often the only difference between level 4 and level 5 is something as small as clicking on the “Track my Rewards” tab on the FNB App once a month.

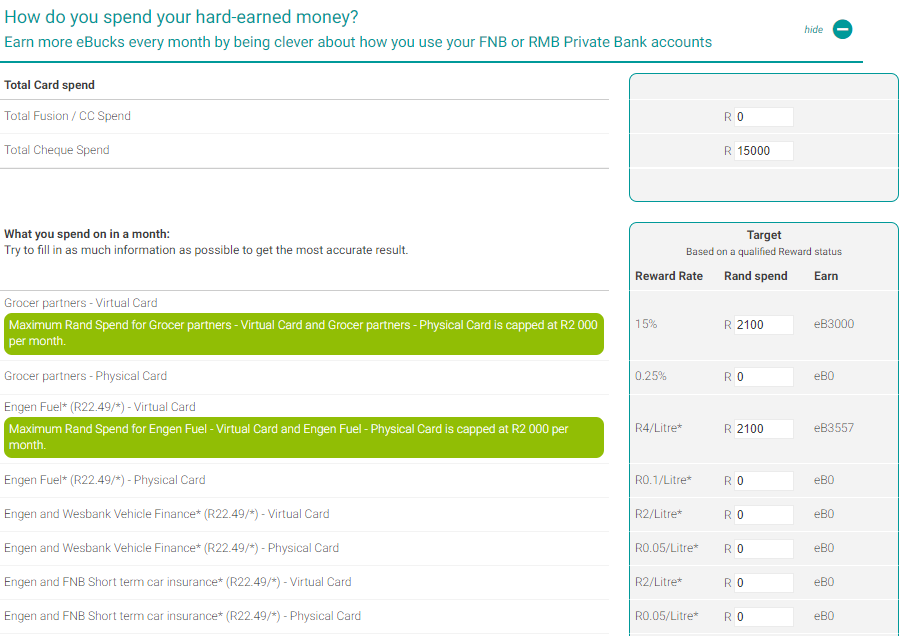

4) Capture your spending habits: Now that you’ve determined your reward level the calculator allows you to capture your spending in various categories in order to show you how many eBucks you would earn per month.

The information is very useful as it will show you the value of spending at the right places. For example on level 5 you can earn 15% back at Checkers, Clicks and the iStore, as well as R4/litre if you buy fuel at Engen. It will also show you if there are maximum Rand spends for certain categories. For example you for an FNB Premier Account you will only earn back 15% of your spend at Checkers on the first R2 000 you spend there each month. Please note that these limits are dependent on your account type. In general, the more expensive your account type is, the higher these limits are.

By using the calculator I keep myself updated on how to optimise my reward earnings and make good decisions about my spending in order to maximise my eBucks rewards.

Case Study: Real-Life Example of eBucks Calculations

Below is a practical example demonstrating the eBucks Calculator’s real-life application.

Let’s say you have an FNB Premier Account. For this account you need 11 000 points to reach level 5. You will be able to achieve this by doing the following:

- Have a minimum monthly deposit (excluding inter-account transfers) into your current FNB Premier Account of R19,500 [2 000 points]

- Do at least 6 financial transactions per month via the FNB App [500 points)

- View the ‘Track my rewards’ tab on the FNB App every month [1 000 points]

- Pay at least 2 bills* using FNB Pay Bills on the FNB App every month (these include municipal rates and taxes, electricity, mobile device accounts, subscriptions and more) [1 000 points]

- Have 3 Smart budget categories set up and access your Smart budget every month OR engage with My net worth monthly OR engage your Credit status monthly [1 000 points]

- Maintain a healthy Credit status on nav» Money with a dark green status [1 000 points]

- Have an active FNB Fusion account with a credit limit and an active card

OR Have an FNB Credit Card account with a credit limit and an active card [1 000 points] - Use your Virtual Card for 80% of your qualifying online spend in a calendar month [2 000 points]

- Use your Virtual Card for 80% of your qualifying instore spend in a calendar month [2 000 points]

- Grow your FNB Savings by at least R1,250 per month [500 points]

Now you that you’re on level 5 if you spend the following amounts using your Virtual Credit card, you will earn eB10 753 which is equal to R1 075.30:

- Total Credit Card Spend: R10 000

- Groceries at Checkers: R2 000

- Fuel at Engen: R2 000

- Spend at Clicks: R2 000

- Netflix: R200

- Spotify Streaming: R100

Try following the steps I showed earlier on to see if you can replicate this example on the eBucks Calculator.

Note that this is just a very basic example. There are other ways to earn eBucks as well. The example I’ve given covers what I believe are most of the common ways that customers earn most of their eBucks.

Eligibility and Enrolment

To start earning eBucks there are certain eligibility criteria you must meet. First you must hold a qualifying account with First National Bank (FNB) or RMB Private Bank.

Here’s a summary of the basic enrolment process:

- Check Eligibility: Ensure that the FNB or RMB Private Bank account you own is compatible. This could be a fusion, current, or a credit card account.

- Sign Up: If you are not yet a member, you can register for the eBucks Rewards Programme without any fee.

Moving forward with the enrolment, the process is fairly straightforward:

- Login to your Online Banking Profile: Using either the FNB or RMB Private Bank’s website.

- Navigate To eBucks: Look for the eBucks icon or follow the arrow prompts leading to the rewards section.

- Join the Programme: Inside the rewards section, you can just sign up to start earning eBucks.

Frequently Asked Questions

What is the rand value of eBucks?

10 eBucks = R1. This converter will do the maths for you.

How can one convert eBucks into rands?

You can’t convert eBucks directly into rands, however, you can use them to pay for products and services at participating eBucks partners. There are certain items that are discounted if you purchase them using eBucks which increases the benefit of eBucks even further.

What expenditure is required to earn eBucks?

As a general rule, always use your virtual credit card when swiping. Aim to spend at the Ebucks partners listed in the article such as Checkers, Clicks, Engen, the iStore, Netflix and Spotify.

How do you use your eBucks?

You can use your eBucks by shopping online at the eBucks Shop or at in-store partners, paying for fuel, or buying prepaid items through FNB’s electronic channels. Just make sure that you’re clever about Where can I spend my eBucks for maximum benefits

How much can you earn in a month with eBucks?

I find it very exceed the R1 000 mark on a regular basis, but I don’t remember ever approaching R2 000 in a month

Conclusion

I’ve shown how easy it is to use the eBucks Calculator. As you can see it’s very possible to get a healthy return if maximise this benefit. Don’t be lazy! Optimise your habits so that you can get this additional R1 000+ every month on autopilot.

*Note that the eBucks rules change from time to time (normally annually), so the information in this article might not be relevant if the rules have changed by the time you read this. The rules don’t tend to change drastically though, so in general I expect the principles to be more or less the same in the near future.

1 thought on “How to earn R1 000 per month using the eBucks Calculator”