Everyone seems to think that registering domestic workers for UIF in South Africa is a mission or that you need to go your nearest labour centre. I’ve also seen UI-8D and UI-19 forms mentioned, but all this is unnecessary if you just do it online. I’m not sure why this seems to be such a well kept secret, but it will take you a few minutes on Ufiling. All you need to do is read the steps below.

Step 1. Register an Account on Ufiling

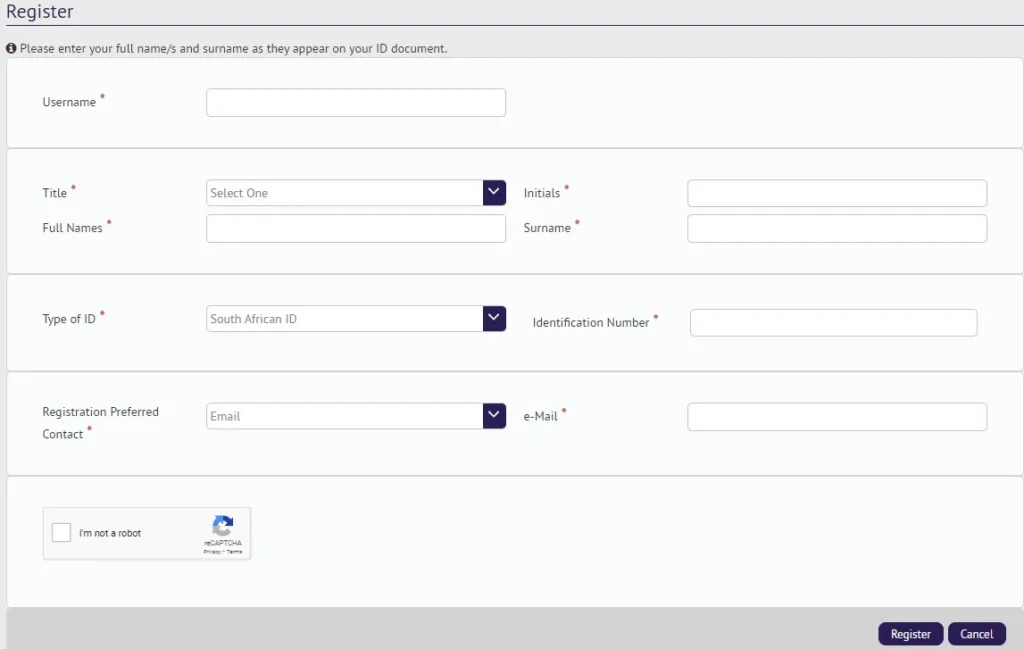

Go to Ufiling and register an account by giving by clicking here and filling in your basic info shown in the screenshot below (Username, Title, Initials, Full Names, Surname, Type of ID, Identification Number, Registration Preferred Contact and Email.) Please don’t forget to click “I’m not a robot” before clicking on Register.

Step 2. Register as an Employer

This involves providing details about your business (in this case, as a domestic employer) and information about your employee (domestic worker).

Step 3. Register Your Employee

Add your domestic employee or employees’ details to the system. This includes their ID number, Name and Surname, address, employment start date and salary information. You’ll also need to indicate whether they are South African or not.

Step 4. Calculate Contributions

UIF contributions are calculated at 2% of the worker’s remunerable earnings per month; 1% is paid by the employer and 1% is deducted from the employee’s wages. Ensure that these calculations are accurately reflected and that the deductions are made correctly from the salary.

This part requires a bit of simple maths as the amount you currently pay your domestic worker should be after the employee deduction of 1%. For example if your domestic worker comes twice a week and you pay her R320 per day, it means her net wage is R640. We need to convert that to a gross wage by dividing it by 0.99 (R640/0.99) = R646.46. So the gross weekly wage before UIF deductions is R646.46.

This needs to be converted to a monthly figure. You can do this by multiplying by 4.33. (R646.46 x 4.33 = R2 799.19).

You will also need to convert the time worked to a monthly figure by using the same formula. For example if she works 16 hours per week (8 hours 2 days a week), you will multiply this by 4.33 as well. (16 x 4.33 = 69). Note that these hours include leave, so you don’t need to adjust for leave.

The UIF contribution amount refers to both the 1% paid by the employer and the 1% deducted from the employee’s wages. So it’s 2%. (R2 799.19 x 0.02 = R55.98

So in this example the numbers will look like this:

Hours Worked (Monthly): 69

Gross Salary Per Month: R2 799.19

UIF Deductible Salary: R2 799.19

UIF Contribution: R55.98

What Next?

You’ve now completed the registration process. Each month, you will need to submit a UIF declaration and the corresponding payments. This can be done through the uFiling system, which allows for electronic submissions and payments.

Payments can typically be made via direct deposit or electronic funds transfer (EFT) through the uFiling system. Make sure the UIF payments are made by the 7th of every month to avoid penalties.

I would recommend paying your workers for their services electronically. It’s much easier making payments from your banking app from the comfort of your home and it’s good to have traceability.

Lets give credit to the unemployment insurance fund – UIF registration is simple! So don’t procrastinate a simple task that could save you a legal headache with the unemployment insurance fund in the future. Your domestic worker will want to claim UIF benefits one day if they have the opportunity so make sure to cover yourself.